Introduction

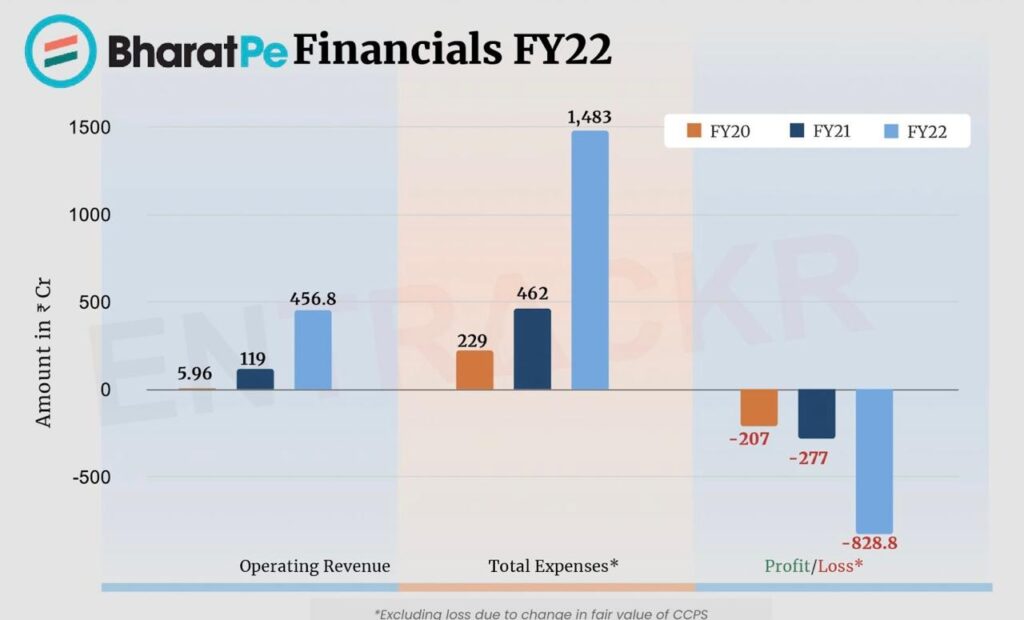

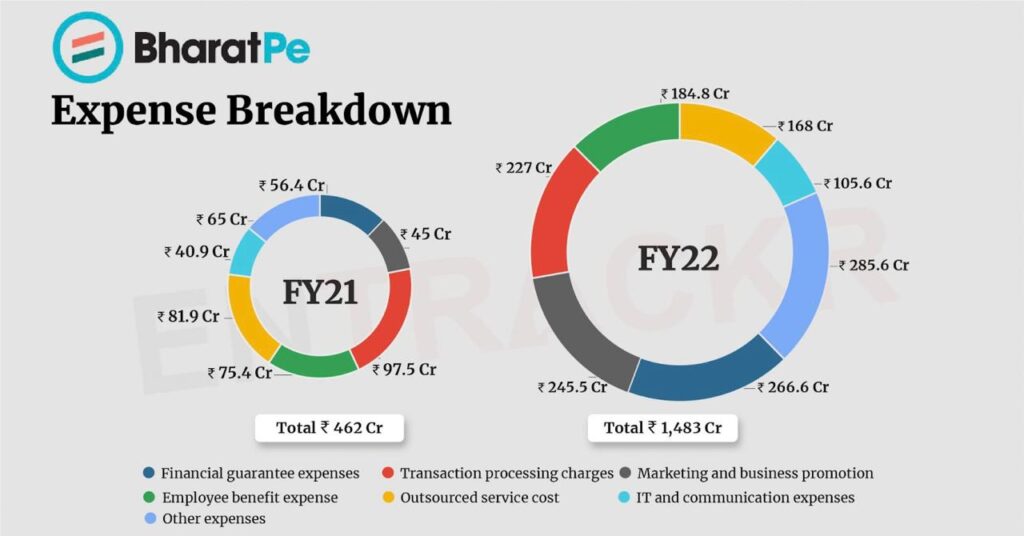

Founded in 2018, BharatPe has rapidly ascended to prominence within India’s digital payments sphere. As a fintech startup, BharatPe has carved out a significant niche by offering a diverse range of financial services tailored to the needs of small merchants and enterprises. The company’s success narrative is a testament to its inventive approach to financial inclusion and its capability to disrupt conventional banking and payment practices in a dynamic market environment.

Market Landscape Prior to BharatPe

Prior to BharatPe’s emergence, India’s digital payment sector was predominantly controlled by a handful of major players, including Paytm, PhonePe, and Google Pay. The landscape was marked by several challenges:

- Limited Financial Access: Numerous small merchants and rural communities had minimal access to formal financial services.

- High Transaction Costs: Conventional payment solutions were often prohibitively expensive for small enterprises, characterized by steep transaction fees and cumbersome processes.

- Fragmented Payment Systems: Merchants grappled with a variety of payment systems, each presenting its own integration hurdles and operational inefficiencies.

- Cash Dominance: Despite the growth of digital payments, cash transactions remained prevalent, especially in smaller towns and rural areas.

Key Differentiators Behind BharatPe’s Success

BharatPe’s ascent can be attributed to several distinguishing factors that set it apart from its competitors:

- Merchant-Focused Strategy: BharatPe’s primary focus was on addressing the unique requirements of small merchants. Unlike other platforms that predominantly targeted end consumers, BharatPe tailored its services to streamline merchant transactions and provide superior financial tools.

- No Transaction Fees: A standout feature of BharatPe was its zero transaction fee policy. By eliminating transaction costs, BharatPe drew in a substantial number of small merchants who were previously deterred by high fees.

- Integrated Payment Solutions: BharatPe provided a unified platform that consolidated various payment methods, including UPI (Unified Payments Interface) and QR codes. This integration enabled merchants to accept payments from diverse sources without the need for multiple devices or accounts.

- Access to Credit: BharatPe introduced financial products such as short-term loans and working capital financing specifically designed for small businesses. These offerings helped merchants manage their cash flow and expand their operations without the reliance on traditional banking systems.

- Data-Driven Insights: Utilizing data analytics, BharatPe offered merchants valuable insights into their transaction patterns, which facilitated informed business decision-making.

- Aggressive Expansion: BharatPe’s swift expansion into underrepresented regions and strategic collaborations with local businesses accelerated its growth across India, penetrating areas where other digital payment solutions had limited reach.

Business Insights

- Prioritize Customer Needs: BharatPe’s success underscores the critical importance of understanding and addressing the specific needs of the target market. By focusing on the challenges faced by small merchants, BharatPe delivered a value proposition that resonated deeply with its users.

- Remove Barriers: Reducing friction points such as high transaction fees can significantly enhance customer adoption and satisfaction. BharatPe’s zero-fee model highlights the impact of lowering financial barriers on user engagement.

- Innovative Solutions Spur Growth: Providing integrated and comprehensive solutions can differentiate a business in a competitive market. BharatPe’s ability to amalgamate various payment methods into a single platform offered it a distinct competitive advantage.

- Leverage Data for Strategic Insights: Harnessing data analytics to provide actionable insights can significantly boost the value proposition for customers. BharatPe’s data-driven approach empowered merchants to optimize their operations and foster customer loyalty.

- Strategic Expansion Drives Market Penetration: Rapid and thoughtful expansion into underserved areas can accelerate growth and enhance market presence. BharatPe’s success in accessing smaller towns and rural regions demonstrates the potential of targeting less saturated markets.

- Adaptability and Innovation: The fintech landscape is continually evolving. BharatPe’s ability to innovate and adapt to shifting market dynamics has been pivotal to its ongoing success.

Conclusion

BharatPe’s journey from a nascent startup to a leading force in India’s digital payments ecosystem exemplifies the power of a customer-centric approach, the removal of financial barriers, and the application of innovative solutions. The company’s success story offers invaluable lessons for businesses aiming to disrupt traditional industries and achieve substantial growth. By understanding and addressing customer needs, eliminating obstacles, and leveraging technological advancements, BharatPe has set a precedent for successful market disruption and rapid expansion.